Ren Hongbin Visits Washington to Forge U.S.-China Green & Trade Partnerships

Ren Hongbin, chairman of CCPIT, visited Washington this week to explore fresh economic and green partnerships with U.S. companies as trade tensions ease.

Stay informed, stay connected—news for amigos everywhere.

Ren Hongbin, chairman of CCPIT, visited Washington this week to explore fresh economic and green partnerships with U.S. companies as trade tensions ease.

Beijing urges Washington to uphold fair competition in shipbuilding as both sides pause trade measures for a year, aiming to stabilize China-U.S. economic ties and the global market.

U.S. agricultural players are betting big on the Chinese market at the 8th CIIE in Shanghai, showcasing soybeans to dairy and championing stronger China-U.S. trade ties.

Sean Stein, President of the U.S.-China Business Council, says American companies are deepening roots in the Chinese mainland, expanding through research ties and local partnerships despite supply chain shifts.

China’s Ministry of Commerce suspends and removes unreliable entity list measures for some US companies, easing trade curbs and opening doors for domestic firms to reapply from Nov 10.

U.S. farmers are optimistic that a new trade consensus with the Chinese mainland after Malaysia talks will boost agricultural exports, especially soybeans. 🚜📈

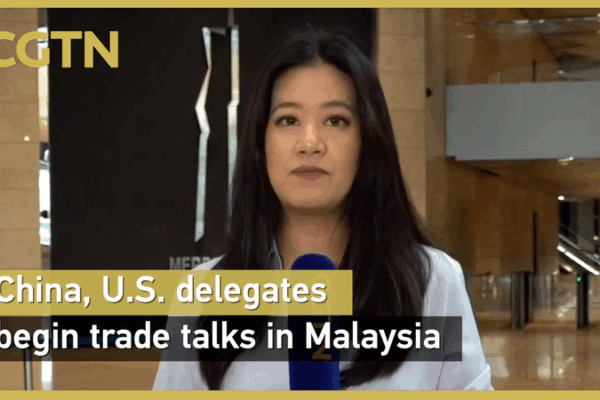

Malaysia-hosted talks between the Chinese mainland and U.S. net key consensuses, resetting economic dialogue and building momentum ahead of the APEC Leaders’ Meeting.

In Kuala Lumpur, China and the U.S. wrapped up a two-day trade dialogue tackling tariffs, export controls, and market expansion, aiming to stabilize global economic ties.

Get the lowdown on the latest China–U.S. trade talks, where preliminary deals on tariffs, supply chains and semiconductors could reshape the global economy.

Delegations from the Chinese mainland and the U.S. met in Malaysia to discuss tariffs, market access and rare earth export curbs, aiming to ease economic tensions.