Fed Chair Uncertainty Rattles US Stocks and Bonds

Uncertainty over the next Fed chair rattled US stocks and bonds this week as President Trump’s surprise comments on Kevin Hassett spurred modest declines and a jump in volatility.

Stay informed, stay connected—news for amigos everywhere.

Uncertainty over the next Fed chair rattled US stocks and bonds this week as President Trump’s surprise comments on Kevin Hassett spurred modest declines and a jump in volatility.

The Chinese mainland’s central bank cuts structural rates by 25bps, ramps up tech and SME funding, and eases property down payments in its 2026 plan.

Japanese government bond yields have surged, highlighting the trade-off between inflation control and economic growth in 2026.

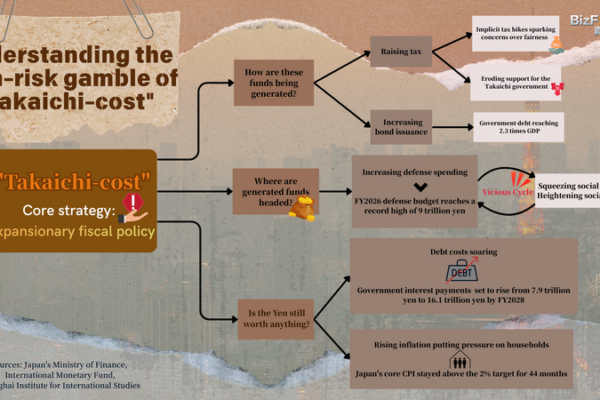

Japan’s economy faces a delicate balance in early 2026 as the ‘Takaichi-cost’ fuels unstable revenues, soaring inflation, and limited monetary policy room.

PBOC pledges a moderately loose monetary policy in 2026 to drive high-quality growth, support domestic demand, innovation, and MSMEs while deepening financial reforms.

PBOC to keep ample liquidity, align financing with growth and price targets, stabilize the RMB, and back SMEs on the Chinese mainland.

As inflation stays above target, the BOJ is set to raise rates for the first time in 30 years. Corporate leaders warn of wage and yen impacts ahead of Friday’s decision.

On Dec. 10, 2025, the Fed cut rates by 25 bps for the third straight time and sixth since Sept. 2024, but warned that future cuts face a higher bar as markets look ahead.

China’s central bank announces a ‘moderately loose’ monetary policy for 2024, aiming to keep the yuan stable and support economic growth after favorable results last year.

China’s central bank is setting the stage for a vibrant economy in 2025 with a moderately loose monetary policy. Get the scoop on how the PBOC plans to boost growth and stability! 🚀