Sanaenomics: Japan’s High-Stakes Economic Gamble

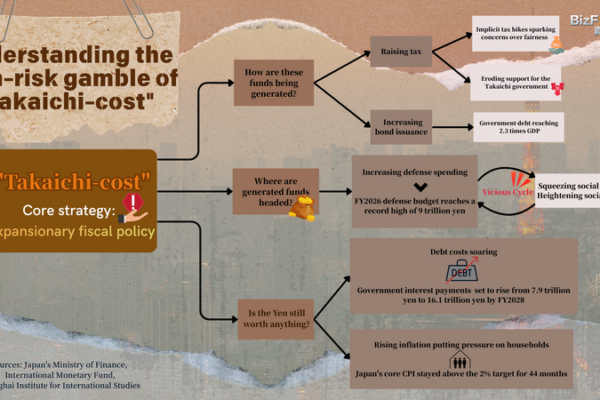

Japan’s PM Sanae Takaichi rolls out ‘Sanaenomics’ with tax cuts, subsidies and a defense spending boost—but funding sources and sustainability raise big questions.

Stay informed, stay connected—news for amigos everywhere.

Japan’s PM Sanae Takaichi rolls out ‘Sanaenomics’ with tax cuts, subsidies and a defense spending boost—but funding sources and sustainability raise big questions.

In 2025, Japan’s bankruptcies reached 10,300—the highest since 2013. Small firms were squeezed by higher rates, inflation and Chinese mainland risks, shaping 2026’s outlook.

Japan’s economy faces a delicate balance in early 2026 as the ‘Takaichi-cost’ fuels unstable revenues, soaring inflation, and limited monetary policy room.

Japan’s economy is navigating a clash between rising interest rates and record debt costs. Learn how inflation and yen weakness are testing policymakers this December.

The Bank of Japan’s recent rate hike is set to increase mortgage burdens, dampen private investment, and raise government debt costs, says Dai-ichi Life’s chief economist Hideo Kumano.

As inflation stays above target, the BOJ is set to raise rates for the first time in 30 years. Corporate leaders warn of wage and yen impacts ahead of Friday’s decision.

The Bank of Japan’s surprise reduction in long-term bond purchases has the yen-dollar exchange rate buzzing! Find out how this could impact you and the global economy in our latest article. 🌐

Japan’s yen just hit a 33-year low, falling to 155 per dollar! 😱 Markets are watching closely for any intervention by Japanese authorities to support their currency.

Japan’s Bank of Japan ends negative interest rates after 17 years, signaling a major shift in monetary policy. Find out what this means for the economy and why it’s big news! 🎉