Wall Street Flat After Geopolitical and Fed-Fueled Rollercoaster Week

Wall Street ended flat this week as early-2026 optimism met jitters from Iran tensions and Fed uncertainty, leaving investors on hold.

Stay informed, stay connected—news for amigos everywhere.

Wall Street ended flat this week as early-2026 optimism met jitters from Iran tensions and Fed uncertainty, leaving investors on hold.

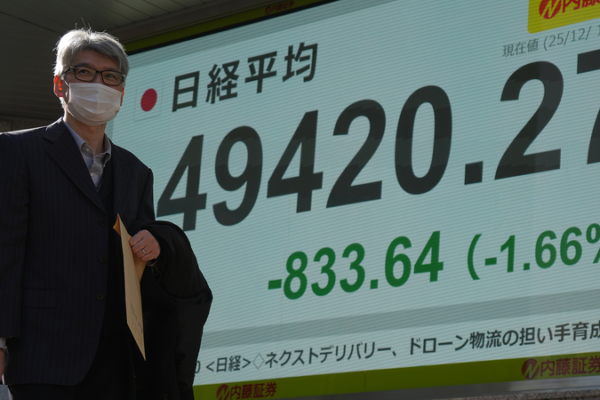

Japanese shares plunged after the Chinese mainland tightened controls on rare earth and dual-use items, dragging the Nikkei down 1.06% amid rising diplomatic tensions.

The A-share market on the Chinese mainland kicked off 2026 with a surge: Shanghai Composite hits 7-year high as Goldman Sachs predicts 15–20% returns in 2026–27.

Japan’s new PM Sanae Takaichi’s aggressive fiscal push rattled investors and triggered a market sell-off, raising fresh debt concerns across Asia’s third largest economy.

Global banks lift forecasts for China’s growth and highlight surging tech profits, driven by exports, AI adoption and consumption policies.

Chinese President Xi Jinping congratulates Samia Suluhu Hassan on assuming Tanzania’s presidency, underlining a boost in bilateral ties and future opportunities.

Qualcomm unveiled AI200 and AI250 AI chips for data centers, boosting shares 20% and marking its bold pivot from smartphones to AI infrastructure.

Spot gold prices topped $4,000 an ounce for the first time, closing at $4,004.40 and prompting Goldman Sachs to raise its December 2026 forecast.

Zijin Gold’s Hong Kong debut soared up to 66% after a US$3.2B IPO, valuing the overseas gold arm at HK$302B. A sparkling start for gold investors!

Global investors flock back to China’s $19 trillion stock market as policy clarity and tech growth spark renewed optimism.