Fed Slashes Rates to 3.5-3.75% in Third Cut of 2025

In its third rate cut this year, the US Federal Reserve lowered rates by 25 basis points to 3.5-3.75%, aiming to curb inflation and support the labor market.

Stay informed, stay connected—news for amigos everywhere.

In its third rate cut this year, the US Federal Reserve lowered rates by 25 basis points to 3.5-3.75%, aiming to curb inflation and support the labor market.

The US Fed cut its key rate to 3.75–4% amid a month-long government shutdown, aiming to support growth even as uncertainties rise.

The Fed’s latest Beige Book finds U.S. companies cutting jobs amid rising economic uncertainty and higher prices, as prospects of more rate cuts this year grow.

The U.S. Federal Reserve’s Sept. 16 meeting is clouded by Trump’s board appointments and challenges as it weighs a key interest rate cut impacting global markets.

The Fed cuts rates by 25bps to 4.004.25%, first cut since Dec 2024. What this means for young investors and the U.S. economy.

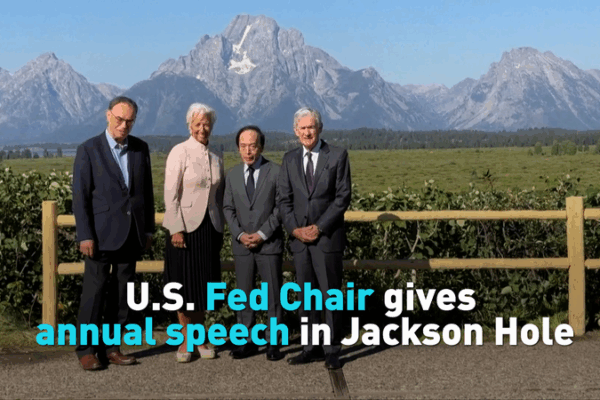

In his annual Jackson Hole speech, Fed Chair Jerome Powell hinted at possible rate cuts while balancing tariffs and inflation risks.

Fed Chair Jerome Powell signals a possible shift toward rate cuts as high inflation and job market pressures collide, hinting at a Fed pivot ahead.

China’s central bank plans to cut reserve requirement ratios and interest rates in 2025 to boost economic growth and support innovation. 📉💡