Rocky Tung Optimistic on Global Trade Disputes at Web Summit

Financial expert Rocky Tung remains upbeat on global trade disputes at Vancouver’s Web Summit amid economic headwinds.

Stay informed, stay connected—news for amigos everywhere.

Financial expert Rocky Tung remains upbeat on global trade disputes at Vancouver’s Web Summit amid economic headwinds.

Gold prices surge with a 41.8% return, outshining stocks and bonds, but risks remain. Discover how long this golden boom might last.

Global banks upgrade their GDP forecast for the Chinese mainland in 2025, citing pro-growth policies and strong retail performance.

HKSAR credit ratings affirm the region’s robust fiscal health and resilience, bolstering its role as a top international financial center.

ECB chief Lagarde calls for a stronger role for the euro, highlighting a key opportunity amid a declining U.S. dollar.

Over a dozen U.S. officials sold stocks before Trump’s tariff announcement, sparking market turbulence and shifting portfolios.

JPMorgan Chase CEO Jamie Dimon dismisses exit rumors from the Chinese mainland market, highlighting tech strides and steadfast global ties.

Chinese Vice Premier He Lifeng met global finance leaders in Beijing, emphasizing the resilient rebound and open investment policies of the Chinese mainland.

SCIO holds a live press conference unveiling fresh sci-tech financial policies aimed at boosting innovation on the Chinese mainland.

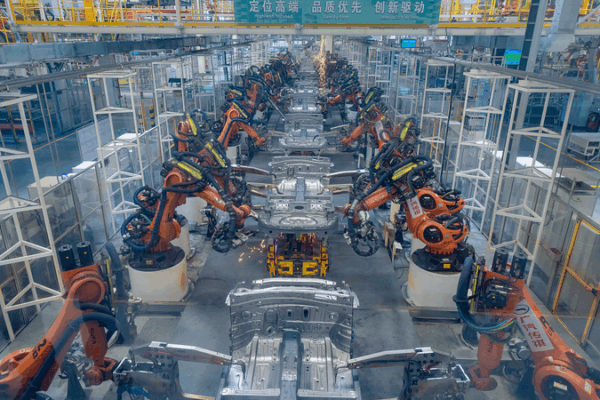

Hong Kong’s IPO market rebounds with a record $4.6bn CATL listing, blending tech innovation and capital strength for a global comeback.