PBOC Calls for Enhanced Global Financial Oversight

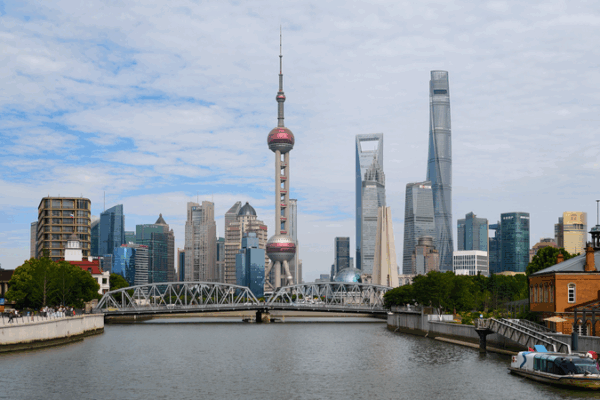

At the 2025 Lujiazui Forum, PBOC governor Pan Gongsheng urged financial institutions to boost oversight for balanced global growth.

Stay informed, stay connected—news for amigos everywhere.

At the 2025 Lujiazui Forum, PBOC governor Pan Gongsheng urged financial institutions to boost oversight for balanced global growth.

Lujiazui Forum in Shanghai unveils eight bold financial policies—from digital yuan initiatives to tech support measures—aimed at reshaping the market.

At the 16th Lujiazui Forum, eight new financial policies signal the Chinese mainland’s bold leap toward global financial openness.

DFTP, the Chinese mainland’s top ship leasing center, signs its 1,000th vessel, marking a major leap in cross-border maritime financing.

Discover the unique path of financial development with Chinese characteristics, blending tradition and innovation on the Chinese mainland.

A new global ranking redefines wholesale banking leadership by spotlighting resilience, digital innovation, and diverse strategic strengths.

Fujian’s local financial experiments laid a modern blueprint for risk prevention, innovation, and economic strength across the Chinese mainland.

Chinese Vice Premier He Lifeng met British Chancellor Rachel Reeves in London, marking a promising step in high-level global exchanges.

Standard Chartered Indonesia boosts Chinese investments in Indonesia with innovative financing, setting a dynamic trend in ASEAN.

Insights from the 2025 Tsinghua PBCSF Global Finance Forum reveal new strategies in growth, transformation, and win-win diplomacy.