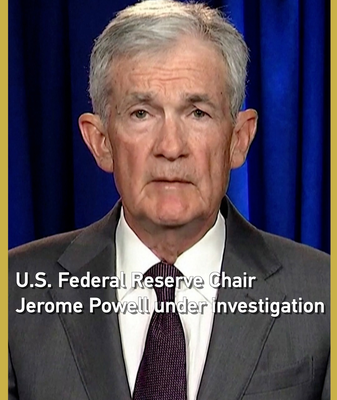

Trump: No plans to fire Fed Chair Powell amid DOJ probe

President Trump says he won’t fire Fed Chair Powell amid a DOJ investigation into a renovation project, while weighing Warsh and Hassett as possible successors.

Stay informed, stay connected—news for amigos everywhere.

President Trump says he won’t fire Fed Chair Powell amid a DOJ investigation into a renovation project, while weighing Warsh and Hassett as possible successors.

Fed Chair Jerome Powell blasts the Trump administration’s criminal probe as a ‘pretext’ to sway interest rates. Former Fed chiefs and GOP leaders warn it endangers U.S. central bank independence.

Fed Chair Powell slams DOJ subpoena as part of Trump’s pressure campaign, warning it could threaten central bank independence.

🚀 The Fed holds its first meeting under President Trump’s second term, tackling inflation and eyeing interest rates. What could this mean for you? Find out more!

Former Fed Vice Chairman Donald Kohn emphasizes the importance of starting and continuing rate cuts as the U.S. Federal Reserve lowers interest rates by 50 basis points amid economic shifts.

Breaking news! The Federal Reserve just cut its benchmark interest rate by a hefty half-point. Find out what this could mean for you! 💸

Americans are gearing up for the first Federal Reserve interest rate cut since March 2022. This potential move could shake up the economy and impact everything from loans to business ventures.

The U.S. unemployment rate rose to 4.3% in July, fueling speculation about an impending interest rate cut by the Federal Reserve. Economists are debating whether the Fed will act soon to prevent a recession.

Big changes ahead! The Fed might cut interest rates starting in September. Find out what this means for you and your finances.

Discover how the U.S. Federal Reserve’s high-interest rates are shaking up the global economy and what it means for countries worldwide.