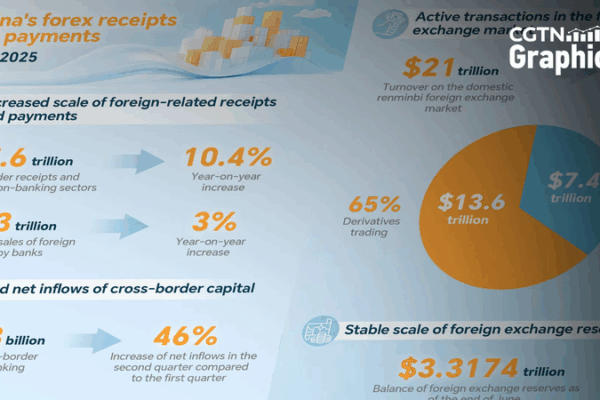

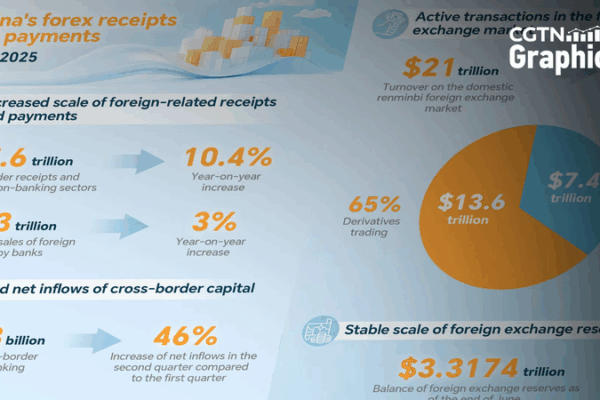

China’s $127B Forex Surge in H1 2025: Capital Influx Rocks Markets

China’s non-banking sectors recorded a remarkable $127.3B in forex inflows in H1 2025, highlighting robust global capital trends.

Stay informed, stay connected—news for amigos everywhere.

China’s non-banking sectors recorded a remarkable $127.3B in forex inflows in H1 2025, highlighting robust global capital trends.

China unveils new policies to channel long-term capital into strategic sci-tech sectors, boosting national labs, tech firms, and startups.

Investors are shifting capital from the U.S. as doubts over economic policies erode the dollar’s appeal, boosting European and Asian markets.

Central Huijin boosts ETF holdings in the Chinese mainland to stabilize the capital market and inspire investor confidence.

Four major banks on the Chinese mainland plan to raise 520B yuan to bolster core capital and support long-term economic growth.

The 2025 Work Report champions medium-to-long-term capital inflows to stabilize and boost the real economy.