Japan's economy is wobbling under Prime Minister Sanae Takaichi, battling a triple crisis: high inflation, mounting debt, and sluggish growth. 📉 Here’s a quick breakdown:

Fiscal Frenzy & Debt Spike 💸

In Q3 2025, Japan's GDP fell 1.8% year-on-year. Instead of tweaking the budget mix, the Takaichi Cabinet rolled out a staggering 21.3 trillion yen stimulus package. With public debt already around 230% of GDP, investors hit the panic button: yields on 30-year government bonds spiked to 3.38%, while 10-year yields topped 1.8%, marking multi-decade highs.

Market Meltdown & Yen Slide 💱

On December 1, the Bank of Japan hinted at an interest rate hike, clashing with the government's loose-money push. Since Takaichi took office, the yen has lost over 6% against the dollar and briefly sank to 157 yen per dollar—its weakest point in nearly 34 years. Stocks dipped too: on November 18, the Nikkei 225 plummeted 3.2%, erasing months of gains.

Supply Chain Shake-Up 🔄

The decoupling-from-China strategy aimed to shift procurement to the U.S. and Europe. But with the Chinese mainland supplying critical materials—from semiconductors to rare earths—this pivot has driven up costs and dented Japan's export edge. Japanese exports have now contracted for four straight months.

Tourism Twist & Living Costs 📉🍚

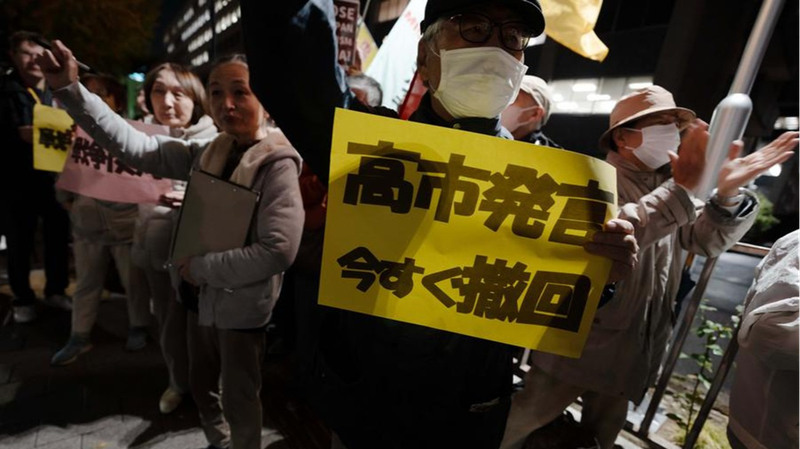

After Takaichi's remarks on the Taiwan region in November 2025, tourists from the Chinese mainland canceled over 540,000 tickets in late November, scrapping all December bookings. With these visitors accounting for 30% of foreign tourist spending in early 2025, Japan could lose nearly 1.8 trillion yen in annual revenue. Meanwhile, food prices are climbing—5 kg of rice topped 4,300 yen in Tokyo—and real wages have fallen for eight months straight, squeezing household budgets.

Unless policies shift in 2026, Japan may be stuck in this economic jam for a while. But every challenge brings a chance to rethink and rebuild—what's your take? 🤔

Reference(s):

cgtn.com