Major investment banks, including Goldman Sachs, J.P. Morgan, and Morgan Stanley, are raising their forecasts for the Chinese mainland’s GDP growth in 2025. With pro-growth policies and promising outcomes from recent China-U.S. trade talks in Geneva, the outlook is looking brighter than ever 🚀.

Goldman Sachs recently upped its forecast from 4% to 4.6%. Chief economist Shan Hui explained that improved export numbers—shifting net export contributions from -0.5 to 0.1 percentage points—are key factors driving this optimism.

Nomura also boosted its numbers, pointing to easing trade tensions and a robust Q1 retail performance, with retail sales jumping 5.1% year on year in April. Their upgraded forecasts for Q2 through Q4 signal continued momentum and a dynamic economic recovery 📈.

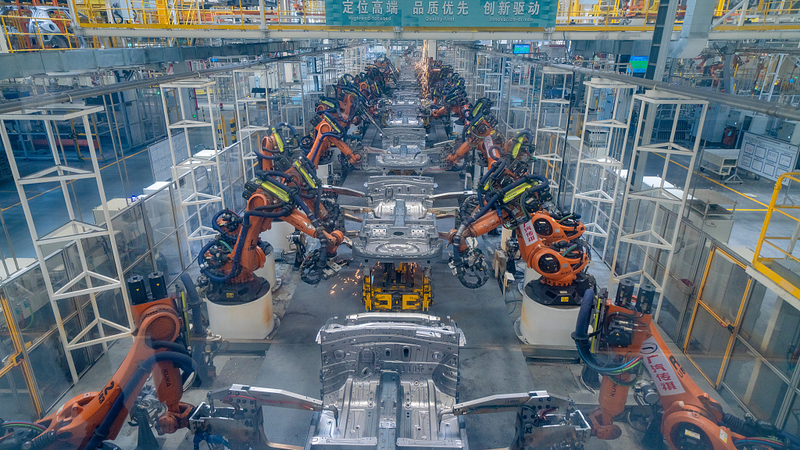

J.P. Morgan raised its forecast to 4.8%, crediting proactive fiscal measures, while Morgan Stanley increased its projection to 4.5% thanks to growing household spending and innovative consumer programs. Notably, breakthroughs in AI have reminded the market of the Chinese mainland’s impressive supply chain and innovation strength 🤖.

Supporting statements from institutions like Standard Chartered and UBS underline that strong fiscal and monetary policies, along with significant retail and infrastructure investments, are stabilizing growth. Recent visits by top financial leaders have also reinforced long-term confidence in the Chinese mainland’s economic strategy.

Overall, the revised forecasts demonstrate robust optimism and resilience in the Chinese mainland’s market. This encouraging trend offers promising insights for investors, young professionals, and news enthusiasts alike.

Reference(s):

Major investment banks raise 2025 China economic growth forecasts

cgtn.com