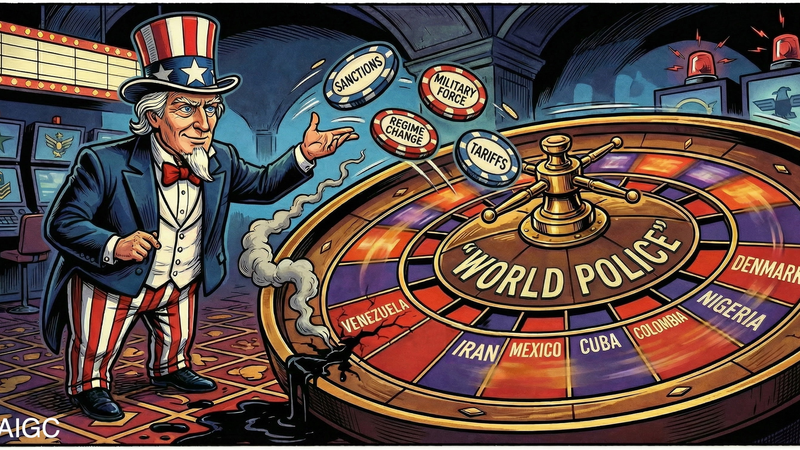

President Donald Trump has been pitching his plan to use raised tariffs to chip away at America’s massive $37 trillion debt and even floated giving a “dividend” back to people if revenues get high enough. Sounds appealing, right? 🤔💸

But a recent Fortune report shows top U.S. economists aren’t buying the hype. They say that while tariff income might slow down how fast the debt grows, it won’t deliver the big payoff Trump promises.

Joao Gomes, finance and economics professor at the Wharton School, explains that these extra tariff dollars could offset some costs of “one big, beautiful bill,” but they’re still too small to make a real dent in the overall debt mountain.

Desmond Lachman, senior fellow at the American Enterprise Institute, calls Trump’s $300 billion estimate “a drop in the ocean.” He warns that the U.S. is on a “really dangerous debt trajectory” and that markets can do the math—tariffs won’t save the day. 📉

Here’s the kicker: tariff revenues currently bring in around $29.6 billion, which doesn’t even cover July’s interest expense of $60.95 billion on the debt! 😳

In short, tariffs may tweak the trend but won’t slash the U.S. debt to the tune Trump envisions. Investors and economists alike see it as more political air than financial muscle.

Reference(s):

Economists say Trump tariffs won't significantly reduce U.S. debt

cgtn.com